0x00_读论文 8

0x11_算法平台 15

0x21_有监督学习 21

0x24_NLP 13

0x25_CV 14

0x26_torch 11

0x31_降维 10

0x33_图模型 10

0x43_时间序列 10

0x51_代数与分析 15

0x56_最优化 11

0x58_密码学 12

0x70_可视化 13

0x80_数据结构与算法 17

国际经济学

Ricardian model

comparative advantage(not absolute advantage), 使用 opportunity cost 来计算.

【生产可能性曲线】

Hechscher-Ohlin model

Richardian model 使用单一资源:labor

Hechscher-Ohlin model 使用两个资源:labor and capital

Trade Restrictions

- reasons that have support from economists

- Infant industry.Protection from foreign competition is given to new industries to give them an opportunity to grow to an internationally competitive scale and get up the learning curve in terms of efficient production methods.

- National security.

- arguments for trade restrictions that have little support in theory

- Protecting domestic jobs.

- Protecting domestic industries

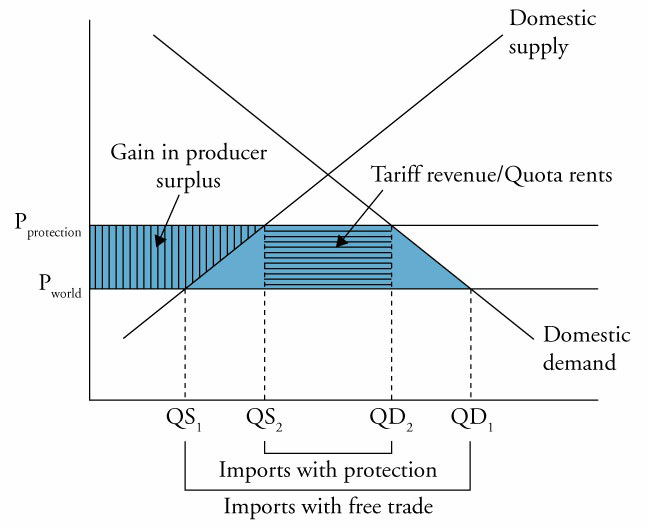

Tools:

- Tariffs 关税

- Quotas 配额

- Export subsidies 出口补贴

- Minimum domestic content: Requirement that some percentage of product content must be from the domestic country.

- Voluntary export restraint: A country voluntarily restricts the amount of a good that can be exported, often in the hope of avoiding tariffs or quotas imposed by their trading partners.

经济学上的理解:

打破贸易限制的组织:

- Free Trade Areas

- All barriers to import and export of goods and services among member countries are removed.

- Customs Union

- All barriers to import and export of goods and services among member countries are removed.

- All countries adopt a common set of trade restrictions with non-members.

- Common Market

- All barriers to import and export of goods and services among the countries are removed.

- All countries adopt a common set of trade restrictions with non-members.

- All barriers to the movement of labor and capital goods among member countries are removed.

- Economic Union

- All barriers to import and export of goods and services among the countries are removed.

- All countries adopt a common set of trade restrictions with non-members.

- All barriers to the movement of labor and capital goods among member countries are removed.

- Member countries establish common institutions and economic policy for the union.

- Monetary Union

- All barriers to import and export of goods and services among the countries are removed.

- All countries adopt a common set of trade restrictions with non-members.

- All barriers to the movement of labor and capital goods among member countries are removed.

- Member countries establish common institutions and economic policy for the union.

- Member countries adopt a single currency.

The North American Free Trade Agreement (NAFTA) is an example of a free trade area, the European Union (EU) is an example of an economic union, and the euro zone is an example of a monetary union.

BOP [balance of payments]

Current Account

- Merchandise and services

- Income receipts. 股息、债券利息

- Unilateral transfers. 工人寄回的工资,外国援助

Capital Account

- Capital transfers.

- debt forgiveness

- financial assets that migrants bring/leave

- the transfer of title to fixed assets

- fundsinked to the purchase or sale of fixed assets

- gift and inheritance taxes

- Sales and purchases of non-financial assets. natural resources and intangible assets, such as patents, copyrights, trademarks, franchises, and leases.

Financial Account

- Government-owned assets abroad. gold, foreign currencies, foreign securities, reserve position in the International Monetary Fund, credits and other long-term assets, direct foreign investment, and claims against foreign banks.

- Foreign-owned assets in the country

国际机构

IMF(international Monetary Fund), World Bank, WTO

- IMF 维持金融秩序和汇率稳定

- 世界银行帮助发展中国家摆脱贫困

- WTO维护国际贸易秩序

汇率

MANAGING EXCHANGE RATES

Countries That Do Not Have Their Own Currency

- formal dollarization

- monetary union

Countries That Have Their Own Currency(货币浮动幅度从小到大:)

- 货币局制度currency board arrangement,货币当局可以发行本币,但数量严格控制,必须以另一种货币做准备。汇率完全固定。香港

- 传统钉汇制度 conventional fixed peg arrangement,汇率变化幅度极小

- 目标钉汇制度 target zone,变化幅度更宽泛

- 爬行钉汇 crawling peg,每隔一段时间调整汇率

- 有管理的爬行钉汇 manage门头 of exchange rate within crawling band

- 管理浮动汇率 managed floating exchange rate

- 完全浮动 independently floating

汇率的影响

- 即期汇率 spot exchange rate

- 远期汇率 forward exchange rate

- 远期升水 forward premium,远期汇率高于即期汇率

- 远期贴水 forward discount

理论1

贬值改善贸易逆差: Marshall-Lerner condition: $W_X \varepsilon_X + W_M (\varepsilon_M – 1) > 0$

where:

- $W_x$ = proportion of total trade that is exports

- $W_m$ = proportion of total trade that is imports

- $\varepsilon_X$ = price elasticity of demand for exports

- $\varepsilon_m$ = price elasticity of demand for imports

结论是,$\varepsilon_X, \varepsilon_m$ 其中一个很大时,贬值才会改善贸易逆差

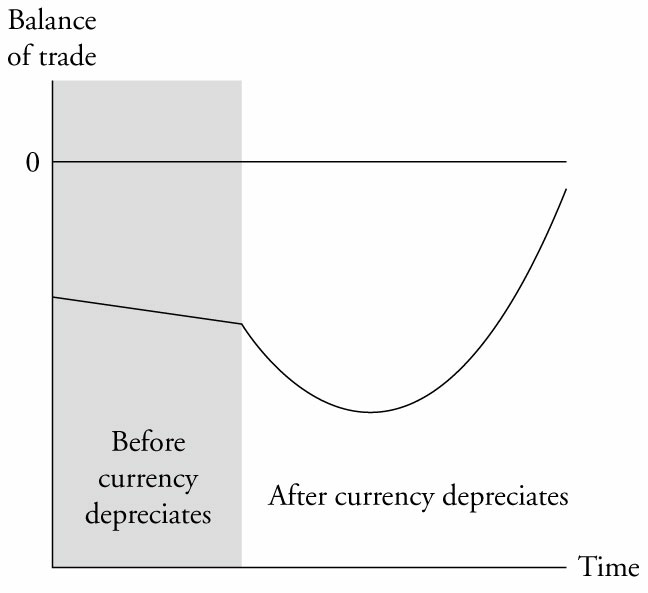

理论2:The J-Curve

接着理论1,贬值初期,经济活动来不及改变,所以逆差会扩大,随后情况会变好

理论3:The Absorption Approach

上面的理论没有考虑 capital flows

- 如果国内没有充分就业,那么本币贬值可以扩大对国内的消费,有效。

- 如果国内已经充分就业,那么本币贬值反而推高物价。

国际经济学理论篇

1、引力模型

$T_{ij}=A*\dfrac{Y_i^\alpha * Y_j^b}{D_{ij}^c}$

其中T代表交易量,D代表物理距离、文化亲和和运输成本

2、国际贸易。

一旦开放贸易,一国充裕要素所有者获利,稀缺要素所有者受损。这是因为要素价格均等化,最终要素价格完全相等。 但是实际上工资差别巨大,这是因为:

- 理想假设两国都能够生产两种商品②理想假设技术水平相同

- 理想假设贸易使商品价格相同④税收和政府支付能抵消分配的影响⑤受损者比受益者更有组织,更能强烈表达观点(美国糖贸易)

3、谷物法和李嘉图。

一个回避内部收入分配的模型。结论是:单一要素下,贸易总是比不贸易好。

4、H-O模型

贸易影响收入分配

5、标准贸易模型

经济增长偏向型,进口型还是出口型。收入转移:边际消费影响福利

6、外部规模经济

外部规模经济导致行业规模扩大(硅谷、好莱坞,瑞士和泰国的手表业)

- 专业化的供应商②劳动力市场专享

- 知识外溢

- 学习曲线

内部规模经济

内部规模经济导致单个厂商规模扩大

国际经济学实践篇

1、反自由贸易的观点:①加入关税收入因素后的整体收益未必上升②出口部门的外部性(参看理论篇6) 2、双边谈判:一种改变贸易不利现状的政治方案。把收益者的利益和受损者的利益联系起来再分配,解决受损者过度反对的问题。(注:西方政治中的游说制度也是同样原理) 3、贸易自由的两个方案: 自由贸易区:政治上简单,执行上复杂 关税同盟:政治上复杂,执行上简单。(可能使福利恶化:例子P229) 4、幼稚工业论(一种反自由贸易的观点):发展中国家有潜在得分比较优势,但最初不能与发达国家竞争。反对改观点:①发展需要步骤②存在假的幼稚工业 5、无偿暂用问题(一种反自由贸易的观点):新市场的开拓者承担成本高于后进者。 对国内工业补贴,使国外不生产,从而增加的利润多于政府补贴损失。

后记:国际贸易的调整实际上是国内利益集团的利益分配,对外政策实际上是国内政治的延续

国际金融学

- 银行利息:算头不算尾

- 1994年起,我国实行单一、有管理的浮动汇率制度

- 1996年12月1日起,我国实行经常项下可兑换

- 即期汇率(银行挂牌价)是银行同业间,即期电汇汇率

- 外汇包括:1、外汇现钞,包括纸币和铸币2、外汇支付凭证或支付工具,包括票据、银行存款凭证、银行卡等3、外币有价证券,包括债券、股票等4、特别提款权5、其他外汇资产

- 现汇和现钞区别。现钞买入价低于现汇买入价。现钞卖出价等于现汇卖出价

- 外汇市场参与者:1、外汇银行:(主体)央行授权经营外汇业务的本国银行和外国银行分行2、外汇经纪人:依靠与外汇银行的密切联系与掌握的外汇信息促成双方成交3、中央银行:有干预外汇市场的职责4、进出口商5、非贸易外汇供求者6、外汇投机者

- 美元/港币 7.????(银行买入美元的价格)~7.????(国际惯例:五位数)

- 1978年9月1日起,美元除对英镑、欧元、新西兰元、澳大利亚元、南非兰特、特别提款权用直接标价法。对其它所有货币都用间接标价法

- 市场规律:等价交换、自愿让渡。供求:买家与买家之间的竞争、卖家与卖家之间的竞争、买家与卖家之间的竞争

- 远期利率,不管是直接标价法还是间接标价法,前小后大是加,前大后小是减。

- 远期汇水=即期利率利差月份/12

- 国际储备的作用:1、缓解国际收支不平衡的冲击2、维持汇率稳定3、借债的保证4、货币发行量

- 资产证券化的增信:1、内部增级:资产池设计、超额抵押、高级/从属参与结构2、外部增级:政府担保、资产池保险、金融担保

- 货币分类:1、商品货币,澳元和加元,所属国家有大量资源出口,商品货币价格与商品价格相关。2、投机货币,英镑、日元。交易量和波动性大,短期波动有较多人为因素。3、避险货币,美元、瑞士法郎。4欧系货币:与欧洲贸易多的国家,与欧元相关5、美系货币:与美元相关。