0x00_读论文 8

0x11_算法平台 15

0x21_有监督学习 21

0x24_NLP 13

0x25_CV 14

0x26_torch 11

0x31_降维 10

0x33_图模型 10

0x43_时间序列 10

0x51_代数与分析 15

0x56_最优化 11

0x58_密码学 12

0x70_可视化 13

0x80_数据结构与算法 17

GDP

- 中间产品不计入GDP,政府转移支付不计入GDP,过去生产的商品的买卖不计入GDP

- 政府提供的产品和服务计入GDP,尽管没有标价,例如警察和司法。

- 自有房屋按照房租折合计入GDP,但房主自己修缮的劳动不计入GDP

- 生产过程中对环境的破坏不计入GDP

- 生产出来但还没卖掉的计入GDP

- 非市场活动,例如以物易物、地下经济、非法交易,不计入GDP

计算

-

收入法(income approach) 收入增加值=劳动者报酬+固定资产折旧+生产税净额+营业盈余

员工工资

业主收入

个人租金收入

公司利润

净利息

对生产的税收

减去:补贴

企业转移支付

政府企业盈余 -

支出法(expenditure approach,value-of-final-output method),计算方法是全部最终产品和服务的加和。

支出法增加值=最终消费+资本形成总额+净出口

消费:耐用品消费、非耐用品消费、服务

投资:固定投资、非住宅投资、住宅投资、企业存货变化

政府购买:中央政府、地方政府

净出口:出口,进口

GDP-折旧=NDP(国内生产净值)

几个相关概念

- nominal GDP for year t

- $GDP_t=\sum\limits_i P_{i,t} Q_{i,t}$

- real GDP for year t

- $GDP_t=\sum\limits_i P_{i,t-5} Q_{i,t}$ (if the base year prices are for 5 years ago)

GDP deflator = nominal GDP/real GDP

- per-capita real GDP

- real GDP divided by population

(expenditure approach)

GDP=C+I+G+(X-M)

- C = consumption spending (耐用品消费+非耐用品消费+购买服务)

- I = business investment (capital equipment, inventories)

- G = government purchases(政府购买物品+政府购买的劳动)

- X = exports

- M = imports

(income approach)

GDP = national income + capital consumption allowance + statistical discrepancy

national income

= compensation of employees (wages and benefits)

+ corporate and government enterprise profits before taxes

+ interest income

+ unincorporated business net income (business owners’ incomes)

+ rent

+ indirect business taxes − subsidies (taxes and subsidies that are

included in final prices)

personal income

= national income

+ transfer payments to households

− indirect business taxes

− corporate income taxes

− undistributed corporate profits

personal disposable income = personal income – personal taxes

fisal balance, trade balance

GDP = C + I + G + (X – M)

GDP = C + S + T

where:

C = consumption spending

S = household and business savings

T = net taxes (taxes paid minus transfer payments received)

S = I + (G – T) + (X – M)

(G – T) is the fiscal balance

(X – M) is the trade balance

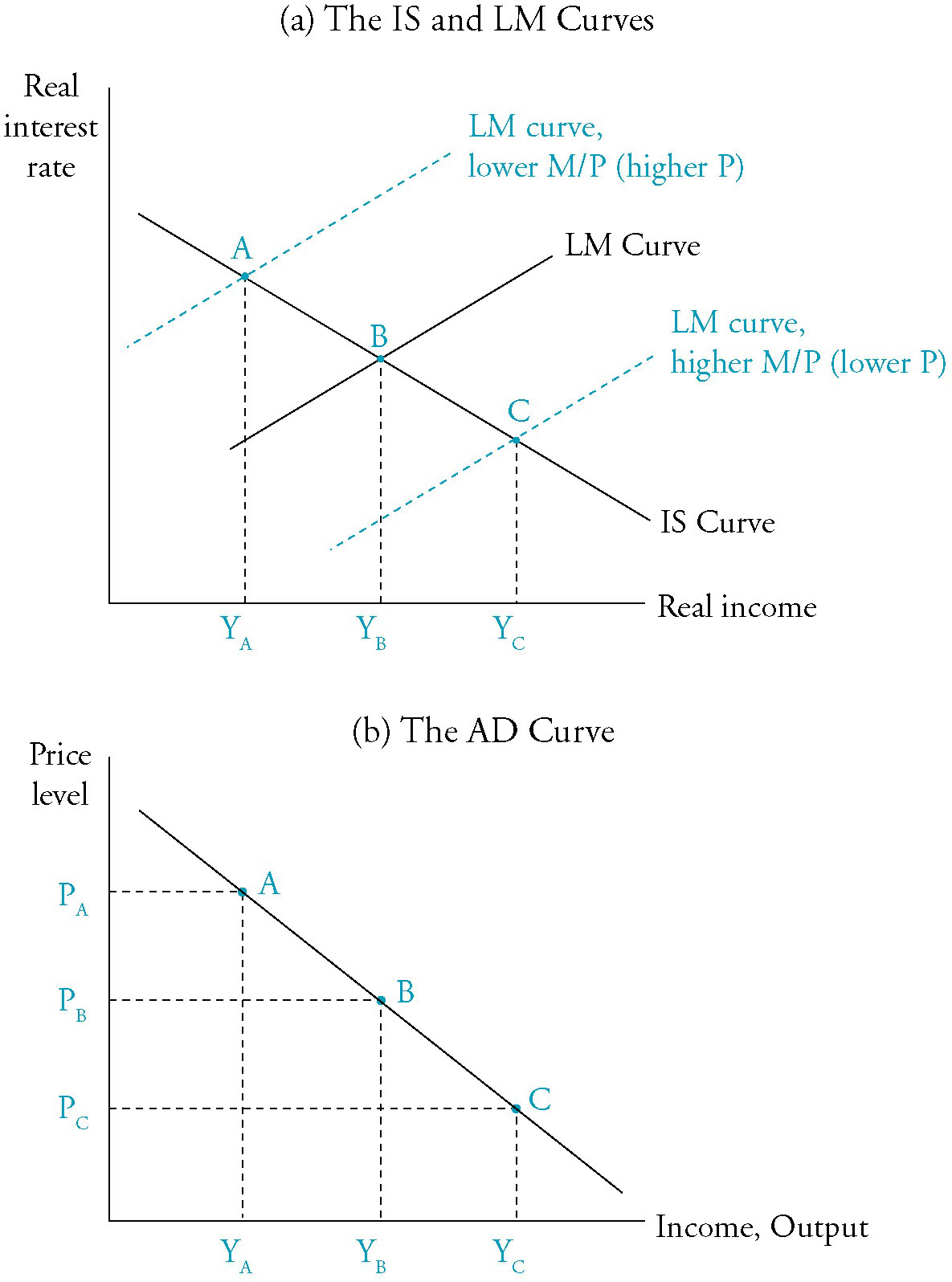

IS-LM-BP曲线

$IS:y=C(y-t)+I(r)+G+X(e,y^1)-M(e,y)$

$LM:M/P=(1/V)Y$(M是名义货币供应,P是价格水平,Y是实际收入/支出,V是货币周转速度,$1/V$是人们愿意为1单位$Y$持有的货币数量)

IS曲线

关于C=C(y)

性质:

- 导数在(0,1),消费增长不会快于收入增长

- APC>MPC,凸性

- c(0)>0,无收入也要消费

假说:

- 杜森贝利。相对收入消费理论:1、棘轮效应2、示范效应

- 莫迪利安妮。生命周期理论:1、消费不只与现期收入有关,而是以一生为依据2、一次性暂时收入变化引起消费变动很小,其边际消费倾向接近0,但永久收入变动边际消费倾向接近1。3、如果税收暂时变动,影响很小,永久变动才有明显效果。

- 弗里德曼:永久消费理论

其他影响消费的因素:

利率:与储蓄有关。收入效应、替代效应

价格:1、改变实际收入2、货币幻觉

收入分配:低收入家庭边际消费倾向大,高收入家庭边际消费倾向小

人口结构:年龄结构、性别结构

社会保障

关于I(r)

r越小,I越大。因为r越小,就有越多的项目 NPV 变成正的。

,进出口,待补充

The aggregate demand (AD) curve slopes downward because higher price levels (holding the money supply constant) reduce real wealth, increase real interest rates, and make domestically produced goods more expensive compared to goods produced abroad, all of which reduce the quantity of domestic output demanded.

LM曲线

货币需求 money demand

- transaction demand

- precautionary demand

- speculative demand

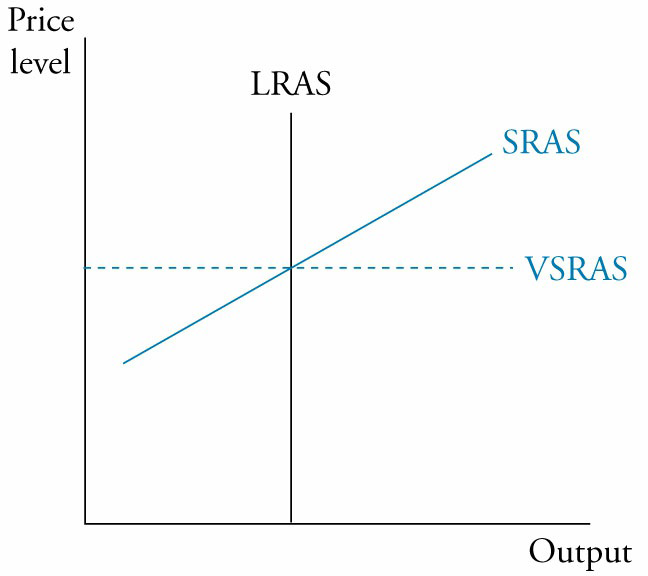

AD-AS曲线

- VARAS(超短期供给曲线),价格刚性不变,例如大萧条时期,即使存在大量失业和资本闲置,其价格也不变

- SRAS(短期总供给曲线)

- LRAS(长期总供给曲线)假定工人不存在货币幻觉,名义工资随着物价调整。

shift AD to right:

- Increase in consumers’ wealth (C increase)

- Business expectations (I increase)

- Consumer expectations of future income (C increase)

- High capacity utilization (increase I)

- Expansionary monetary policy (decrease interest rate. lower interest rate increase investment. lower interest rate also increase C, because durables are typically purchased on credit)

- Expansionary fiscal policy (increase G, or increase C for tax cut)

- Exchange rates (A decrease in the relative value of a country’s currency will increase exports and decrease imports.)

- Global economic growth (increase exports)

shift SRAS to the right

Short-Run Aggregate Supply(SRAS)

- Labor productivity: an increase in labor productivity will decrease unit costs to producers.

- Input prices: A decrease in nominal wages or the prices of other important productive inputs will decrease production costs and cause firms to increase production, increasing SRAS. Wages are often the largest contributor to a producer’s costs and have the greatest impact on SRAS.

- Expectations of future output prices: When businesses expect the price of their output to increase in the future, they will expand production, increasing SRAS.

- Taxes and government subsidies: Either a decrease in business taxes or an increase in government subsidies for a product will decrease the costs of production. Firms will increase output as a result, increasing SRAS.

- Exchange rates: Appreciation of a country’s currency in the foreign exchange market will decrease the cost of imports. To the extent that productive inputs are purchased from foreign countries, the resulting decrease in production costs will cause firms to increase output, increasing SRAS.

shift in LRAS to the right

The long-run aggregate supply (LRAS) curve is vertical (perfectly inelastic) at the potential (full-employment) level of real GDP.

- Increase in the supply and quality of labor

- Increase in the supply of natural resources

- Increase in the stock of physical capital

- Technology

MACROECONOMIC EQUILIBRIUM

都是从 AD-AS 图上来解释,有4种:

- long-run full employment。是 AD-SRAS-LRAS 相交于一点的情况,图自己脑补。这个交点也叫做 long-run full-employment equilibrium.

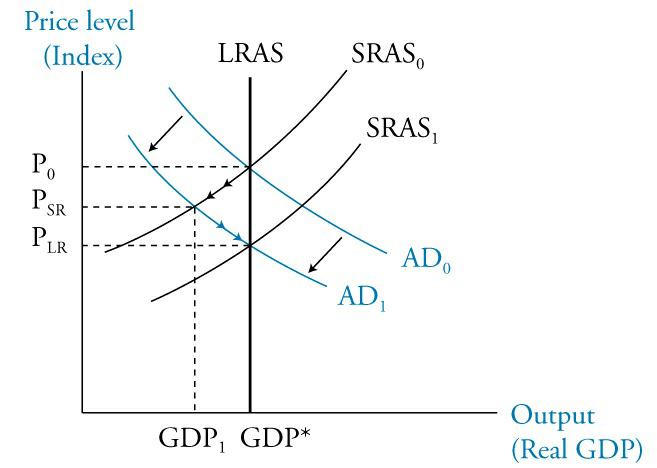

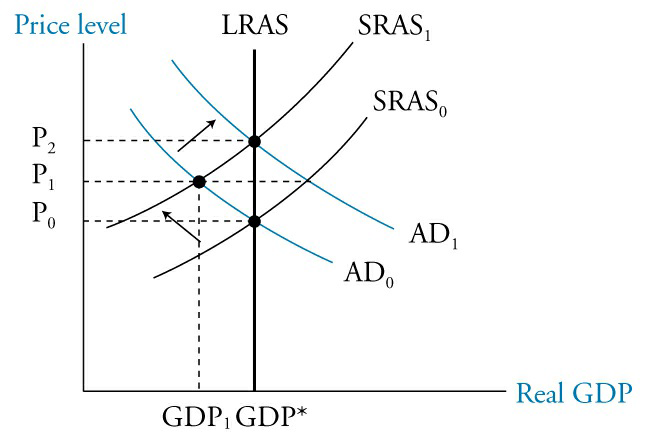

- short-run recessionary gap. 诱因是 AD 曲线突然左移。

下图画出的第二步是 Classical economists 的观点,认为 SRAS 会在之后调整,回到 新的 long-run full-employment equilibrium.

在 Keynesian economists 看来,不能依赖自动调整,而是要通过宏观调控使 AD 回到原来的位置。

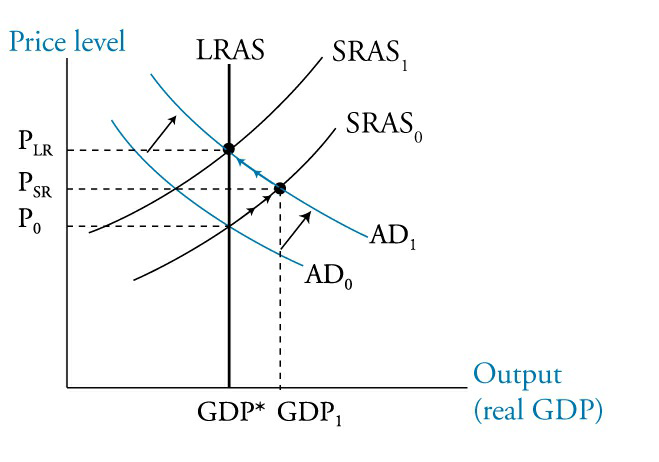

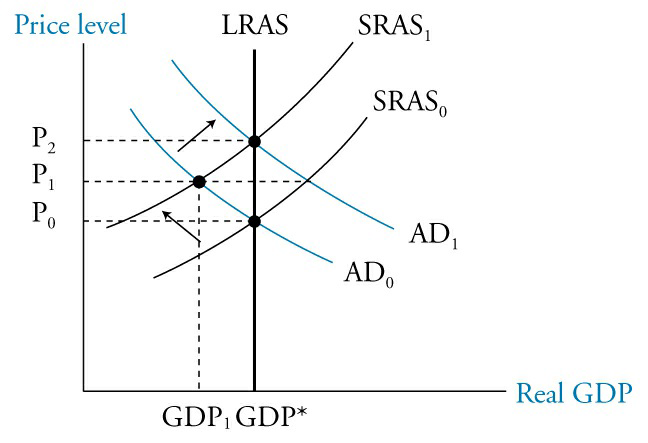

- short-run inflationary gap. 诱因是 AD 曲线突然右移

下图画出的第二步是 Classical economists 的观点,认为 SRAS 会在之后调整,回到 新的 long-run full-employment equilibrium.

在 Keynesian economists 看来,不能依赖自动调整,而是要通过宏观调控使 AD 回到原来的位置。

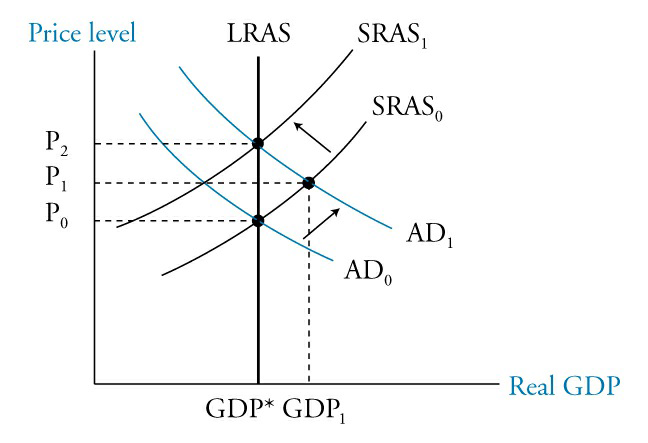

- short-run stagflation. 原因是 SRAS 左移,而 SRAS 左移的原因是可能是劳动力、原材料价格上涨。

直接后果是高通胀和高失业率。长期来看,SRAS 会逐渐回到原有水平,但这种回归机制太慢。一般使用宏观调控,使AD曲线右移,解决失业率问题,但进一步推高通胀(图中的第二个箭头),然后用宏观调控抑制通胀。

投资策略:

- recession gap.

- 企业利润下降,所以放弃周期性行业,转投防御型行业

- 商品价格下降

- 央行可能会降息。高风险债券违约率上升,所以放弃垃圾债券,转投低风险债券。长期债券价格上涨会比短期债券更多。

- inflation gap

- 企业利润上升

- 商品价格上涨

- 央行可能加息。投资高风险债券,放弃低风险债券。

- stagflation gap

- 商品价格上升。投资商品,投资商品相关行业

- 企业利润下降。减少非商品行业的投资

- 通胀提高了名义利率。减少固定收益证券的投资

BusinessCycle

体现在 unemployment, inflation, real GDP 的变化。

- 期限。谷底trough。扩张 expansion。定点 peak。衰退 contraction/recession

- 失业率和通胀都是滞后指标

有一些指标,可以反映经济周期

- inventory-sales ratio

- adjusting utilization of labor and physical capital (因为频繁调整数量的成本很高)

- housing sector. 尽管只是经济的一小部分,但房价与经济周期很相关。利率与贷款有关。收入和需求相关。投机行为。人口结构。

- 进出口。进出口取决于本国GDP,友国GDP,汇率。

对 business cycle 的解释

neoclassical shool

- shift in AD/AS are driven by changes in technology.

- business cycle result from temporary deviations from long-run equilibrium.

- the economy has a strong tendency toward full-employment equilibrium.

Keynesian school

- business cycle result from shifts in AD due to changes in expectations.

- wages are “downward sticky”

- policy : increase AD, through monetary policy or fiscal policy

New Keynesian school: prices of productive inputs are also “downward sticky”.

Monetarist school

- cause: business cycle result from variations in AD due to variations in the rate of growth of money supply, likely from inappropriate decisions by the monetary authorities.

- recessions can be caused by external shocks or by inappropriate decreases in the money supply.

- policy: to keep AD stable and growing, the central bank should follow a policy of steady and predictable increases in the money supply.

Austrian school

- cause: government intervention in the economy

New Classical school

- real business cycle theory (RBC) emphasizes the effect of real economic variables such as changes in technology and external shocks, as opposed to monetary variables, as the cause of business cycles.

- RBC applies utility theory.

- policy: not try to counteract business cycles because expansions and contractions are efficient market responses to real external shocks.

unemployment

回忆一下这些名词:

- Frictional unemployment

- Structural unemployment

- Cyclical unemployment

了解一下这些名词:

- unemployment rate

- labor force = employed + unemployed

- underemployed. 例如,有能力但只能找到兼职的,大学教授做清洁工

- participation ratio = (employed + actively seeking employment) / working-age population

- discouraged workers

Inflation

Inflation 是几乎所有商品的,持续不断的价格上升。

Inflation 有利于借款人。

名词

- hyperinflation

- Disinflation,是通胀减少,但仍然大于0

- deflation 通货紧缩

计量

- CPI为代表的,是固定权重

- GDP deflator为代表的,权重是变的(与当期实际消费有关)

- 还有些领先指标 producer price index (PPI) or wholesale price index (WPI)

- Headline inflation refers to price indexes for all goods. Core inflation refers to price indexes that exclude food and energy. 因为食物和能源更变化多端,所以排除掉后,数值会稳定很多,也就更有用。

分类:

- Laspeyres index, which uses a constant basket of goods and services.

缺点如下:- New goods

- Quality changes

- Substitution

- hedonic pricing ,主要解决上面的 Substitution 问题

主要有两种实现:- Fisher index. A Fisher index is the geometric mean of a Laspeyres index

- Paasche index. A Paasche index uses the current consumption weights, prices from the base period, and prices in the current period.

通胀的产生机理

- Cost-Push Inflation

诱因是AS曲线左移(AS左移的原因可能是原材料和能源价格、工资上升)

第二步是政策使AD曲线右移,如图

(额外说明一下工资上升,如果只是单纯的工资上升,而不是效率提高导致的工资上升,才算到这个里面,新指标:unit labor cost)

(工资上升还会导致 expected inflation) - Demand-Pull Inflation

诱因是AD曲线右移(AD右移可能的原因是积极地财政政策、货币政策,或者其他因素)

第二步是推高工资,使SRAS曲线左移

经济周期指标:

- Leading indicators: Average weekly hours in manufacturing; initial claims for unemployment insurance; manufacturers’ new orders for consumer goods; manufacturers’ new orders for non-defense capital goods ex-aircraft; Institute for Supply Management new orders index; building permits for new houses; S&P 500 equity price index; Leading Credit Index; 10-year Treasury to Fed funds interest rate spread; and consumer expectations.

- Coincident indicators: Employees on nonfarm payrolls; real personal income; index of industrial production; manufacturing and trade sales.

- Lagging indicators: Average duration of unemployment; inventory-sales ratio; change in unit labor costs; average prime lending rate; commercial and industrial loans; ratio of consumer installment debt to income; change in consumer price index.

Fiscal&MonetaryPolicy

- fiscal policy

budget surplus:tax>expenditures,budget deficit:tax<expenditures - monetary policy

expansionary(accommodative, easy)

contractionary(restrictive, tight)

money

money has 3 primary functions:

- medium of exchange/means of payment

- unit of account

- store of value

Narrow money: notes and coins

Broad meney: narrow money + liquid assets

概念:M1/M2/M3

早期的货币是,你把稀有金属放到银行,银行给你 promissory notes(银行本票)。久而久之,大家用 promissory notes 进行交易,这就产生了 fractional reserve banking (部分准本金银行制度)

银行的钱借和存,产生一个概念 money multiplier

货币理论1

$MV=PY$,

monetarists 认为V和Y变化缓慢,因此M与P强相关。

货币理论2

demand for money:

- transaction demand

- Precautionary demand.Money held for unforeseen future needs. The demand for money for precautionary reasons is higher for large firms.

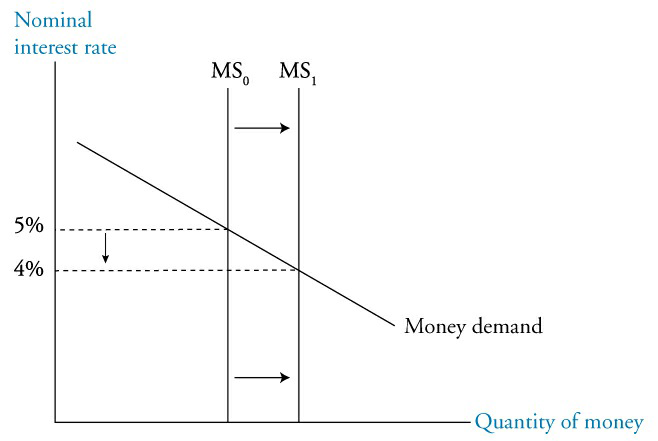

- Speculative demand. 收益越低,这个存量就越多。因此demand曲线是斜向下的(下图)

货币理论3

看上面这个图,

- 第一点是均衡如何实现。如果点落在均衡点左边,持有 money 的机会成本很高,人们就会去做投资。如果点落在均衡点右边,人们卖掉资产换取 money

- MS(money supply)完全无弹性。

- MS 受 central bank影响。

货币理论4

nominal interests = real interests + expected inflation

Fisher effect:real interest are stable. changes in interest rates are driven by changes in expected inflation.

实际上,nominal interests = real interests + expected inflation + riskpremium for uncertainty

roles and objectives of central banks

roles of central banks:

- Sole supplier of currency. 一开始由黄金背书,后来 was deemed legal tender by law,这就是 fiat money(法定货币)

- Banker to the government and other banks: Central banks provide banking services to the government and other banks in the economy.

- Regulator and supervisor of payments system

- Lender of last resort

- Holder of gold and foreign exchange reserves

- Conductor of monetary policy

objective of a central bank: control inflation (高通胀会产生 menu costs 和 shoe leather costs),除此之外,央行还有其它目标:

- Stability in exchange rates with foreign currencies.

- Full employment.

- Sustainable positive economic growth.

- Moderate long-term interest rates.

costs of unexpected inflation 远高于 costs of expected inflation

- costs of expected inflation 主要来源于人们不希望持有货币,而频繁买卖债券的成本(随着互联网发展,这个成本越来越小)

- costs of unexpected inflation

- 会造成债券的 lender 和 borrower 收益受益或受损,因为无法预测,因此 lender 需要更多的回报以补偿风险,这造成投资不足。

- 对价格变化的预期不准确,会导致经济不在均衡点上。例如,生产商对价格的预期失误,可能导致存货异常,生产能力扩大和缩小不合理,这些都导致 real costs on an economy

money policy

tools:

- Policy rate. bank 可以从当局借钱,这个钱利率较 discount rate/refinancing rate.

常用的操作方式是 repurchase agreement,The central bank purchases securities from banks that, in turn, agree to repurchase the securities at a higher price in the future. 这个价差可以用来调节工笔供应量。 - Reserve requirements,法定存款准备金

- Open market operations

monetary transmission mechanism

(how monetary policy affects price level and inflation)

以紧缩为例,4个传导机制都会使 AD曲线左移:

- Banks’ short-term lending rates increase. The higher rates will decrease AD as consumers reduce credit purchases and businesses cut back on investment in new projects.

- Bond prices, equity prices, and asset prices in general will decrease. This may have a wealth effect. Both consumers and businesses may decrease their expenditures because their expectations for future economic growth decrease.

- The increase in interest rates may attract foreign investment in debt securities, leading to an appreciation of the domestic currency relative to foreign currencies.

- An appreciation of the domestic currency increases the foreign currency prices of exports and can reduce demand for the country’s export goods.

three essential qualities

- Independence: operational independence & target independence

- Credibility

- Transparency

注意一下,货币政策传导机制中,有几条稍微有点绕:

- 货币政策改变利率,进而改变国际货币市场的情况,然后改变汇率,然后改变进出口。

- 所有链条都先改变 AD 曲线,进而改变 inflation,employment,real GDP

- 改变利率后,可以改变消费,这个机制靠的是信用卡、消费贷

货币政策盯紧的目标:

- interest rate,过去经常用这个

- inflation,应用广泛

- exchange rate,主要是发展中国家。可能会使货币供应波动较大。可能使本国外汇耗尽。通胀与目标国一样,这无视了国内经济政策。

货币政策的不足

- 如果通胀来自 AD 高涨,紧缩货币有用;如果通胀是输入型的,紧缩货币可能导致萧条。

- 紧缩货币会导致短期利率上升,但可能导致长期利率下降。这是因为长期利率=

limitation of monetary policy

- monetary tightening increase the probability of recession, making long-term interest reduce.

Money supply growth is seen as inflationary, increasing long-term interest. - liquidity trap. ndividuals willingly hold more money even without a decrease in short-term rates. demand for money becomes very elastic and individuals willingly hold more money even without a decrease in short-term rates.

- 萧条期银行不愿意外借资金

fiscal policy

Objectives of fiscal policy may include:

- Influencing the level of economic activity and aggregate demand.

- Redistributing wealth and income among segments of the population.

- Allocating resources among economic agents and sectors in the economy

Fiscal policy tools include spending tools and revenue tools.

- Spending Tools

- Transfer payments, also known as entitlement programs, redistribute wealth, taxing some and making payments to others. Examples include Social Security and unemployment insurance benefits. Transfer payments are not included in GDP computations.

- Current spending refers to government purchases of goods and services on an ongoing and routine basis.

- Capital spending refers to government spending on infrastructure, such as roads, schools, bridges, and hospitals.

- Revenue Tools

- Direct taxes are levied on income or wealth. These include income taxes, taxes on income for national insurance, wealth taxes, estate taxes, corporate taxes, capital gains taxes, and Social Security taxes. Some progressive taxes (such as income and wealth taxes) generate revenue for wealth and income redistributing.

- Indirect taxes are levied on goods and services. These include sales taxes, value-added taxes (VATs), and excise taxes.

【这里有个计算题 18.3】

针对赤字财政的争论:

- for being concerned with the size of fiscal deficit

- Higher deficits lead to higher future taxes. Higher future taxes will lead to disincentives to work and entrepreneurship. This leads to lower long-term economic growth.

- If markets lose confidence in the government, investors may not be willing to refinance the debt. This can lead to the government defaulting (if debt is in a foreign currency) or having to simply print money (if the debt is in local currency). Printing money would ultimately lead to higher inflation.

- Increased government borrowing will tend to increase interest rates. crowding-out effect

- against being concerned with the size of fiscal deficit

- If the debt is primarily being held by domestic citizens, the scale of the problem is overstated.

- If the debt is used to finance productive capital investment, future economic gains will be sufficient to repay the debt.

- Fiscal deficits may prompt needed tax reform. Deficits would not matter if private sector savings in anticipation of future tax liabilities just offsets the government deficit (Ricardian equivalence holds).

- If the economy is operating at less than full capacity, deficits do not divert capital away from productive uses.

两种财政政策:

- discretionary fiscal policy

- automatic stabilizers

不足:

- lag

- Recognition lag

- Action lag

- Impact lag

- Additional macroeconomic issues

- Misreading economic statistics

- Crowding-out effect

- Supply shortages: If economic activity is slow due to resource constraints (low availability of labor or other resources) and not due to low demand, expansionary fiscal policy will fail to achieve its objective and will probably lead to higher inflation.

- Limits to deficits: There is a limit to expansionary fiscal policy. If the markets perceive that the deficit is already too high as a proportion of GDP, funding the deficit will be problematic. This could lead to higher interest rates and actually make the situation worse.

- Multiple targets: If the economy has high unemployment coupled with high inflation, fiscal policy cannot address both problems simultaneously.

旧版

财政政策

定义:政府通过变动税收和支出一边影响总需求,进而影响就业与国民收入的政策 手段:税率、政府购买、转移支付 缺点:1、时滞(内:从出现问题到认识到问题,从认识到问题到决策,外:从调整直接目标到最终目标变化) 2、不确定性:乘数、时间 3、挤出效应:G增加,产品市场购买方竞争加剧,价格上涨,m=M/P下降,m2=-hr减少,债券价格下降,利率提升,投资减少 4、外部不确定性

货币政策

货币当局通过银行体系变动货币供给量来调节总需求的政策

手段:再贴现率(告示作用)、法定准备金率、公开市场业务、道义劝告、消费者信用控制、不动产信用控制、优惠利率

缺点:1、时滞

2、对付萧条时无能为力:1.厂商悲观,降低利率也不肯投资2.银行为了安全,不轻易贷款3.流动性陷阱

3、以货币流动速度不变为前提,但是萧条期货币流动速度慢,繁荣期货币流动速度快

4、微观主体预期的抵消:没有被公众知晓才有效

5、透明度与取信

6、开放经济中,三元冲突

7、对通胀:需求拉动型有效,成本推动型无效

福利经济学

福利经济学第一定理:任何竞争性市场均衡都是帕累托有效的。 福利经济学第二定理:如果个人偏好是凸的,对初始禀赋的再分配,每一个帕累托有效配置都是一个竞争性均衡

一般均衡论存在的条件: 1、消费者依据偏好与预算线,选择最大化效用的商品组合 2、消费者依据偏好与预算线,选择其所提供的数量 3、生产者依据??????,选择利润最大化的商品 4、所有市场同时达到均衡(均衡:现行价格下供求相等)

公平的定义: 平等主义:每个人效用相等 罗尔斯主义:最糟的人效用最大化 功利主义:社会总的效用最大化 市场主导主义:

阿罗不可能定理:非独裁下,不可能存在有适用于所有个人偏好类型的社会福利函数,